A Shoutout to IPwe

IPwe was capitalism at its most pure, and it was a noble and honorable effort by Erich Spangenberg, founder of IPwe, to attempt to build a better marketplace for patents. After years of using his asymmetrical edge in the patent system to accrue hundreds of millions in patent licensing and litigation outcomes with IPNav, Erich recognized the destruction the AIA would have on the patent litigation system long before most others did. Having unique insights and experience in the world of patents, Erich picked up where IPXI left off, this time building a trading platform and valuation tool using the latest technology. IPwe was built in collaboration with IBM through its Blockchain Accelerator. The IPwe platform was built as a transaction marketplace for patents and IP, and shifted into a data and analytics business, but it had trouble hitting critical mass. Sadly, there are too many headwinds for IPwe to make it past the current patent stasis that is the result of the American Invents Act (AIA)’s Patent Trial Appeal Board (PTAB) system for invalidation of patents. That system has made IPwe’s mission too big of a lift for a private innovator to solve on his own. More is needed from the Government too.

In a perfect capitalist society, private industry solving inextricable problems for the benefit of all while making a profit is the ideal outcome. Some problems, however, are too big for private enterprise. For most large companies, which I will define as having a market capitalization or business enterprise value above $20 billion, the growth was almost always aided in some way by a federal government. Unfortunately, the US government has not provided aid or the structural clarity needed for IPwe to create a patent marketplace.

But how has the government aided other large companies? For example, all global mapping systems benefit from the US government’s initial research and development to create a Global Positioning System (GPS). Another example includes the US’s Federal Highway system, which logistics supply chain companies use regularly to profit from transporting goods across America. It was the Federal Government that helped smooth the way for profit-making enterprises to grow and prosper, but that is not what is happening in the US patent system, and IPwe did not receive the public-private partnership it needed to grow.

In my experience with patents, the US regulators are stymied and frustrated, causing grievances to patent owners of all types, sizes, and locations. Many people in the patent industry have held ideas or fascination with building a transactable, tradable patent and IP marketplace, but only a few have attempted it, and all have failed. Unfortunately, IPwe is the latest iteration of the patent marketplace that has failed to gain traction, leading to its bankruptcy announcement in February this year. Founded by Erich in 2018, the IPwe platform had a long run of “trying to boil the ocean.” Like its predecessor, IPXI, implementers were largely unwilling to buy or license patents through the IPwe platform, making the marketplace one-sided, with sellers or licensees but not enough willing licensors or buyers, and the analytics not useful.

In speaking with IPwe CEO, Leann Pinto, the company hopes to emerge from bankruptcy with a new, clean capital structure that will enable them to continue growing the business’s data analytics product and services. The challenge for IPwe (or any patent transaction marketplace) is, and will continue to be, unwilling implementers. The large companies with little to no desire to in-license patents and IP its already using, and counter patent litigation with “that patent never should have been issued” defense, makes creating a market place impossible. Accordingly, Big Tech’s primary goal is to maintain the status quo.

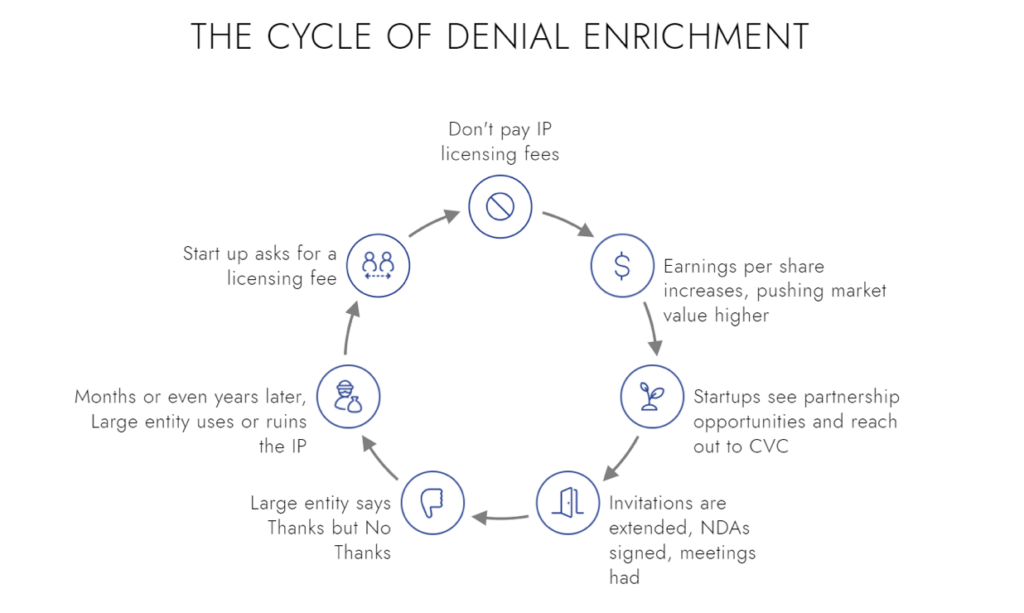

The Cycle of Denial Enrichment

For large companies, it must have a strong stream of cash flow and profitability. The larger the market value, the higher the cash flows for a large company. As the financial markets have moved towards more automated trading platforms, large companies have become almost robotic about their quarterly earnings calls and seek to align the expectations with Wall Street analysts. On occasion, an earning surprise for these large companies will send a shock through the stock, moving it up or down dramatically (e.g., the Lyft typo’s impact on its stock price is an example). Shortly after the surprise, the stock will resettle at its new level, but if large companies start paying patent licensing fees, the guidance on earnings moves down across many quarter. This is a fundamental issue for why large companies almost always deny patent infringement accusations. They are incentivized to deny it because large companies might begin to see a steadier stream of outbound licensing agreements, resulting in lower earnings per share. This would break the cycle of denial, resulting in systemic change for most companies. As a result, the cycle of denial must stay intact.

Once companies’ earnings are released, algorithm trading uses the information in the transcripts to enact trading strategies that align with the results. Accordingly, the predictability of quarterly earnings reports becomes critically important to the trading machines that make the financial markets work. Paying third-party patent licensing fees is disruptive to those orchestrated earnings outcomes, so denying and not paying becomes commonplace, particularly when the Magnificent Seven are the leaders of not paying patent and IP licensing fees to third parties. “If they’re not paying, why should we pay?” is a common (unspoken) belief amongst the large companies.

As a result, $20B+ companies have an (unstated) obligation to deny paying third-party patent and IP licensing requests indefinitely. Most large companies follow their own version of the unwritten playbook of denial and delay, and with patents only having a 20-year life (or less if not utilized), it is easy to run out the clock before paying a patent licensing cent— the process of the Cycle of Denial Enrichment.

As an initial start, the base action is to not pay patent or IP licensing fees from third parties. Of course, many large companies claim they pay IP licensing fees, but I would estimate that +90% of those patent license fees are by the hook of evidence of use (EoU). I invite any CIPO from any $20B company to prove to me otherwise.

Recently, there have been a number of large company to large company patent and IP licensing deals. Ericsson, Nokia, Sisvel, Broadcom, Intel, and others are announcing large nine-figure licensing deals for six or seven years. These licensing deals are applauded by industry watchers as a success of the patent industry to cohesively work together. But those are just the headlines. Below the surface, where the reporting goes less often, are the smaller and individual inventors who are getting steamrolled by the Cycle of Denial Enrichment.

After a company denies licensing fees, it will maintain or improve its earnings per share, pushing its market value higher. Improving market value acts as a beacon signal of growth. Since early stage, inventive companies are looking for fast scaling to get adoption of its technology; inventive tech companies will seek partnerships with Corporate Venture Capital (CVC) groups. Almost every company worth more than $100B has a CVC or invests in a group CVC. The investment statistics and outcomes for CVCs are varied and difficult to benchmark, but what cannot be denied is that these CVC arms invite early-stage companies into their posh headquarters in Silicon Valley or the Northwest and they entice them with investment, which brings down the startup’s guards.

After NDAs are signed and the conversations are going well, the larger company will invite the startup’s product development teams in for technical discussions. The large company will bring five people to one for the startup, making for a 25-to-35-person room. The meeting will last hours or even days, with detailed technical discussions that eventually lead to confirming ideas or technical specifications for the large company’s team. Many people would call that technical data trade secrets that are being transferred unwittingly. The meetings will end with thanks and praise. And promises for callbacks. Then, the startup company’s CEO and technical teams will wait anxiously for the callback. Days will turn into weeks. Weeks into months, and then the email: Thanks, but No Thanks.

Because startup companies are ambitious, competitive, and focused, they move on to the next opportunity for growth. Entrepreneurs who are also inventors do not want to pick fights. Literally every inventor I have ever met, which is thousands of them at this point in my career, do not want patent litigation to be their source of income. Patent litigation only serves to benefit two parties: the lawyers and the infringers. Are there inventors who just want to litigate? Certainly not anymore. They have dogmatic notions of licensing to a large company, but they would be going down a hopeless road if licensing IP and patents is the primary path to riches.

Eventually, sometimes years later, the startup’s IP will show up in the same large company’s product. Or the company will take the trade secrets and publish them in a patent application, which happened to Masimo vs Apple. If the startup catches the large company in the act of infringement, the startup should have an opportunity to address the infringement in court and get a settlement or purchase. Not anymore. Now, companies who find out that a large company is infringing its patents, must litigate to receive restitution. And the restitution is always below what the patent holder believes is fair value. More likely, however, is that the patent holder loses the patent in an IPR process, a devastating blow for an inventor to be reversed in such a manner.

Given the relative ease to delay and not pay by large corporations, most companies deploy the cycle of denial enrichment as the (unwritten) standard operating procedure. Add to that with invalidation rates on US patents above 80% when instituted, the risk of invalidation casts a pall on the entire patent system in the US, which smothers smaller and individual patent holders from making reasonable decisions. And it acts like a roadblock for innovation for a company like IPwe.

In the face of these odds, it was a valiant effort to try and build IPwe, and I hope that its technology assets can be deployed after restructuring. I have seen and used the technology built by the team at IPwe and am impressed with what they have accomplished. I am hopeful that some separate iteration of the platform is repurposed to eventually make it easier to license patented IP rather than steal invalidate it, but that is a pipe dream in today’s marketplace.

What is the Lesson?

The loss of another attempt at an IP market maker is less a reflection of the idea, and more on the absence of the right incentives. There are certain things that private industry simply cannot do without the right help and involvement from government to align the incentives. Fixing the US patent system while also making a transactable marketplace is one of those issues. Unfortunately, the US Congress is so overwhelmed with non-patent-related issues that fixing patents is a low priority. It is unfortunate because the European and Asian patent systems are going to leapfrog the US in the next 5 to 20 years without action.

While there is pending patent legislation being debated like PERA, some inventors believe it doesn’t go far enough. Meanwhile, large companies think the AIA is working fine and are behind the scenes trying to keep it as is or strengthen it. Given how broadly and extensively patent infringement is in the US, I would not let perfect be the enemy of good and take the reform that is available now. But the large companies will continue to fight to keep the current status quo. Why buy the cow when you are getting the milk for free?

Given large companies’ efforts to keep things the same, patent and IP marketplace cannot exist, which is unfortunate for IPwe. Until regulators and legislatures realize that the cycle of denial enrichment will spin endlessly, the road to an IP marketplace will be blocked.

Matt Moyers

Managing Director at Peak Value IP, LLC

Matt is a semi-retired IP valuation professional and has been part of the IAM Strategy 300 for six straight years. He operates Peak Value IP, LLC, a patent and intellectual property (IP) consulting firm that focuses on financial valuation, monetization, and strategy services. He has 24 years of experience providing financial advisory services for transactions and valuation for public and private clients. His roles are project to project, and he has been involved with or managed over ~20,000 business or IP valuations over his career

Thanks in support of sharing such a pleasant thinking, post is

nice, thats why i have read it entirely