The ISM Purchasing Manager’s Index was below 50% for the 14th consecutive month in December. In particular, new orders and backlogs were contracting in December. A figure below 50% is an indication of a contracting economy. ISM doesn’t make any predictions in their reports. What is interesting is that the contraction coincides with the Fed raising interest rates. When interest rates are high, consumers have less money to buy “wants” vs. necessities, and companies have less money to use for capital improvements. The initial inflation was caused by shortages from supply chain disruptions and shutdowns during the COVID pandemic, so I don’t understand the theory that raising interest rates would curb inflation. To me, raising interest rates causes more inflation.

The good news is that several organizations have a more positive outlook for 2024, especially with regard to certain trends. After reviewing several newsletters and articles about the 2024 manufacturing outlook, there is considerable consensus about trends that will continue and grow in the coming year.

Deloitte’s 2024 Manufacturing Industry Outlookstates, “In 2023, the US manufacturing industry capitalized on the momentum generated by three significant pieces of legislation that were signed into law in 2021 and 2022—the Infrastructure Investment and Jobs Act (IIJA), the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, and the Inflation Reduction Act (IRA). Together, these laws prioritize rebuilding infrastructure, advancing clean energy initiatives, and building out the domestic semiconductor industry, while also aiming to foster job growth, workforce development, and equity. By introducing an infusion of funds and tax incentives into US manufacturing across various sectors…the IIJA, CHIPS, and IRA have already spurred record private sector investment in the manufacturing industry.”

AME’s Manufacturing Today magazine features an article titled, 10 Manufacturing Trends for 2024: Shaping the Future of Industry. These trends include:

Digital Twins – “The adoption of digital twins, virtual replicas of physical manufacturing systems, will skyrocket. These digital simulations enable real-time monitoring and optimization, enhancing efficiency and reducing downtime…facilitate advanced scenario planning and troubleshooting, enabling manufacturers to simulate and predict the impacts of various operational changes and external factors on their systems.”

Reshoring – “With a focus on supply chain resilience, manufacturers are increasingly bringing production back to their home countries. Reshoring efforts aim to reduce dependency on foreign suppliers and mitigate supply chain disruptions.”

Reskilling Workforce – “Training programs will focus on digital skills, automation, and data analysis. The reskilling initiatives will likely focus on interdisciplinary skills, blending traditional manufacturing knowledge with digital expertise.”

Industrial Automation – “Automation will continue to expand across manufacturing processes, with robots and cobots boosting productivity and accuracy. Advanced automation will not only include robotics but also incorporate AI for more intelligent decision-making processes.

Additive Manufacturing – “3D printing and additive manufacturing will become even more integral to the production process. This technology allows for rapid prototyping, customization, and reduced waste.”

Industrial Internet of Things (IIoT) – Increased connectivity through IIoT devices will provide real-time data for better decision-making. This will lead to improved asset management and predictive maintenance. The IIoT will lead to more interconnected and smart supply chains, where data from various stages of manufacturing can be integrated for more cohesive and transparent operations.”

The December 12, 2023 Thomasnet.com Insights newsletter reported that when The Association for Supply Chain Management held their annual conference in September, ASCM members voted on what they believe are the top trends in supply chain for 2024. The top three trends were:

1. Digital Supply Chains – “As antiquated paper processes go the way of the dinosaur, it brings along with it improvements in streamlining, resilience, and agility. Supply chain leaders who leverage digital tools will find themselves better prepared and more able to handle dynamically changing orders.”

2. Supply Chain Investments – “A newcomer to the ASCM list this year — and the fastest climbing — is supply chain investments in both systems and people. This emphasizes just how much corporate leaders now see the value in prioritizing their supply chains and the benefits of adding talent and tech tools to ensure visibility and, ultimately, success.”

3. Relocation – Reshoring continues to hit record levels, and Accenture adds that many companies are turning local for their supply chain needs. Specifically revealing that, by 2026, 85% of companies plan to manufacture and sell their products in the same region. In this way, companies ensure they are addressing the vulnerabilities that arose from their highly globalized supply chains in recent years.”

The December 19, 2023 thomasnet.com Insights newsletter featured an article titled, 2024 Trends: AI, Automotive, Sustainability, and Reshoring, that stated, “2024 is the year that every company will adopt artificial intelligence to further modernize operations. More than 70% of the manufacturing CEOs who have already implemented AI have already seen a significant return on investment in areas such as supply chain management and procurement, according to Xometry’s Q4 CEO Sentiment Survey, which was completed with Forbes and John Zogby Strategies.”

Another one of the trends is “In 2024, we won’t just see companies talk-the-talk on a net-zero emissions future. Instead, we will watch them proactively take steps to limit greenhouse gas emissions across industrial supply chains through investments and decarbonization tracking tools.”

The article states, “Finally, a greener supply chain isn’t the only logistics trend to expect in 2024. With an ongoing emphasis on the importance of domestic manufacturing, U.S. companies will continue to reshore at greater rates this year, creating resiliency to withstand future shocks. In fact, 76% of manufacturing CEOs at the end of 2023 had already reshored — up significantly from earlier in the year. Investments in reshoring have been accelerated by the “Build America, Buy America” initiative.”

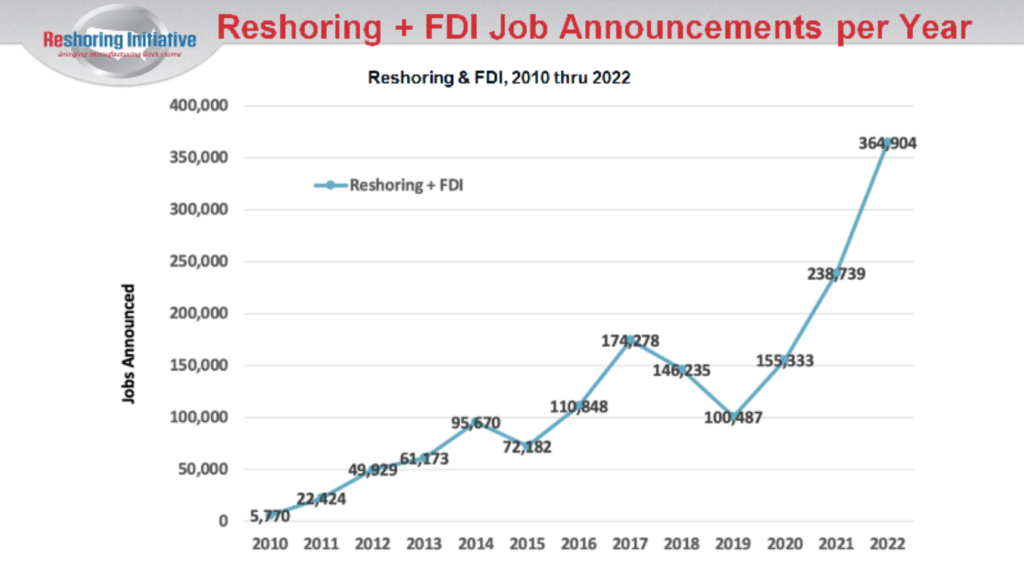

Note that “reshoring” is a trend mentioned by all three organizations. This is a trend that was increasing every year since 2011, but accelerated as a result of the supply chain disruptions during the COVID pandemic. According to the Reshoring Initiative 2022 Data Report, “In 2022, 364,000 jobs were reshored (up 53% from 2021), according to the Reshoring Initiative. The reasons for this new growth were threefold:

- Manufacturers are nervous about relations with China and are bringing production back to the U.S.

- Biden administration initiatives—the Inflation Reduction Act, the Infrastructure Bill, and the Chips Act—have offered both direction and financial security for companies willing to invest in American manufacturing.

- Third, tariffs are working. A good example is the Section 232 tariffs for the steel and aluminum industries.

The problem is that at the current rate, it would take 30 years to recoup the +5 million jobs we lost between 2000 and 2010. If we kept up the pace of 2022, it would still take 15 years. We need to implement some of the policies I have recommended in previous articles to incentivize more reshoring, such as my article, “How Could we Reduce Inflation and Balance Foreign Trade & the Federal Budget?” Balancing the overvalued dollar would go a long way toward increasing reshoring by making American goods more competitive on the world market. Fixing the U.S. dollar would also expand the manufacturing workforce. In addition, across the board tariffs on Chinese goods would reduce imports and encourage more people to Buy American, incentivizing manufacturers to reshore to take advantage of increased consumer interest in buying Made in America goods. We must become self-sufficient again in producing manufactured goods if we want to remain a free and independent country. Our national security is at stake.

Michele has been president of the San Diego Electronics Network, the San Diego Chapter of the Electronics Representatives Association, and The High Technology Foundation, as well as several professional and non-profit organizations. Michele is currently a director on the boards of the American Jobs Alliance and San Diego Inventors Forum. She is also a mentor for CONNECT's Springboard program for startup companies and is Chair of the California chapter of the Coalition for a Prosperous America. She is a columnist for Industry Week's e-Newsline and an authorized speaker for the Reshoring Initiative.

Michele earned a B.A. from San Diego State University in 1982 and a certificate in Total Quality Management in 1993. She is a 1994 graduate of San Diego's leadership program (LEAD San Diego) and earned a Yellow Belt Certificate in Lean Six Sigma in 2014. She is the author of four books: For Profit Business Incubators published by The National Business Incubation Association in 1998, two editions (2009 and 2012) of Can American Manufacturing Be Saved: Why we should and how we can, and Rebuild Manufacturing - the key to American Prosperity.